Soft Solutions for Resiliency: Is your community prepared?

February 7, 2024 · Insights

By Rob Brown, PE, PhD

Understanding the Community Rating System and its programs to benefit your community.

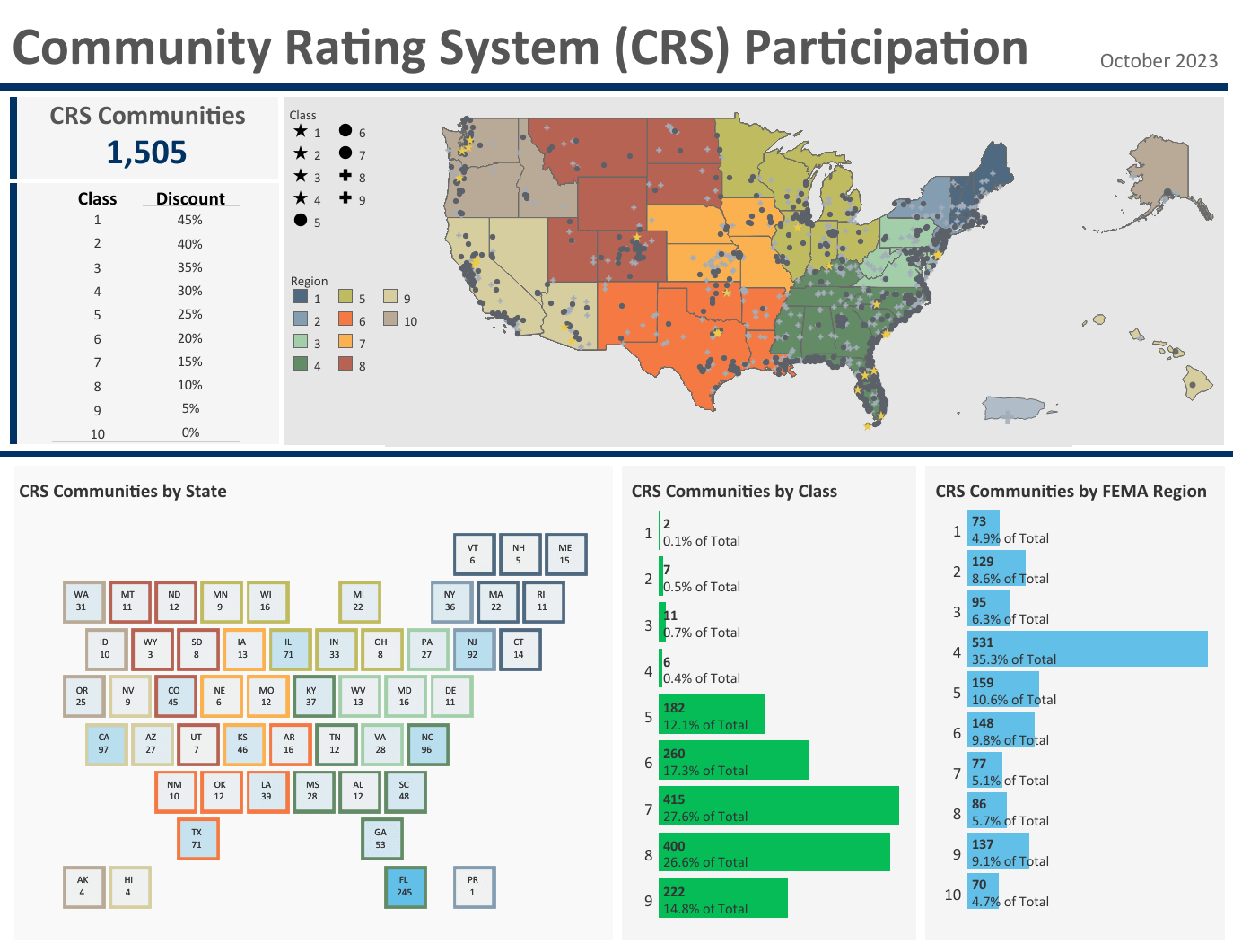

Community Rating System (CRS) is a voluntary program associated with the FEMA National Floodplain Insurance Program (NFIP). While “floodplain” is in the name, there are many stormwater management activities that are credited under this program. Under CRS, communities accrue points for engaging in creditable activities and are rewarded for doing more than regulating construction of new buildings to the minimum national standards. In addition to the benefit of a more resilient community, all flood insurance policyholders in the community are rewarded with discounted flood insurance premiums ranging from a 5% to 45% discount.

Nationwide, there are 1,505 communities that participate in this program, and more than one-third (531) are in the Southeast. The CRS Data Visualizations page is a great place to visualize the data of participating communities. Additionally, if you want to see where your community ranks within your state, visit your state profile page.

Two programs within CRS that can greatly contribute to points and result in reductions in flood insurance premiums are “Higher Regulatory Standards” and “Open Space Preservation.”

The Open Space Preservation program targets land located in the Special Flood Hazard Area (SFHA), which is the FEMA regulatory 100-year floodplain. Additional credit is awarded for protecting these areas as open space and not developing within them. This can be accomplished through zoning strategies, enhanced buffer requirements, or land acquisition and conservation. Some coastal areas have begun to explore land use overlay districts as a tool to protect future marsh migration areas to mitigate flooding and improve CRS ratings since these areas are generally the current day floodplain (SFHA).

One item associated with Higher Regulatory Standards is “Freeboard,” which is the additional elevation above the current 100-year floodplain, or base flood elevation (BFE), that buildings are required to be built for their lowest finished first floor. Freeboard provides a margin of safety against more severe storms and increased future flood risks from the increased frequency of large storms everywhere and rising sea levels along the coast. In most floodplain ordinances, freeboard is generally applied to SFHA only (e.g., A, AE, or VE flood zones.)

However, there are a few coastal communities, that have begun to add requirements to the “X 0.2%” flood zone (also referred to as the shaded X zone or 500-year floodplain) because with the addition of sea level rise or occurrence of larger storms, portions of these areas will eventually migrate to the SFHA. This includes Camden County, GA as well as Hampton and Norfolk, VA, which have specified to elevate the finished first floor elevation of a building to at least 1 or 1.5 feet above the highest adjacent grade at the building site.

In addition, some communities have developed (and regulate to) a higher “local” or “future” floodplain that is developed by modeling the floodplain considering the impact of future buildout, re-development, intensity of development, weather-related changes, etc. This also increases the freeboard above the FEMA SFHA.

GMC has assisted several communities with their applications to join the Community Rating System Program and others to improve their ratings, including McIntosh County, Bryan County, Tybee Island, Brunswick, Kingsland, Richmond Hill, Garden City, Thunderbolt and Pooler in Georgia, as well as Mobile County, Alabama. For more information, contact Rob Brown or Ed DiTommaso.